Buying a home involves plenty of steps. Home buying process can be lengthy and overwhelming, especially when you are buying your first home. Thankfully, you can get rid of a lot of issues with proper planning. If you have decided to buy a house in 2021, and you are wondering about what you should know to get it right, then here’s a step by step guide on buying a house that simplifies the process for you.

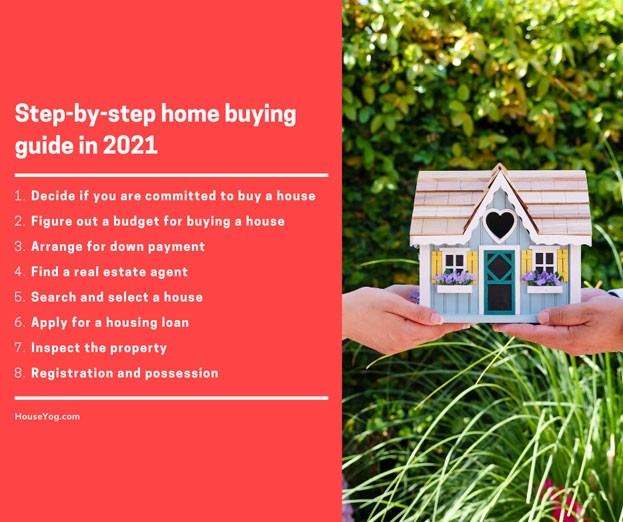

8 easy steps to buying a house

In order to make the process of buying a house in 2021 easier for you, we have created a 8-step guide that simplifies the process for you.

- Decide if you are committed to buying a house

- Figure out a budget for buying a house

- Arrange for the down payment

- Find a real estate agent

- Search and select a house

- Apply for a housing loan

- Inspect the property

- Registration and possession

Choosing to buy a house is a huge decision and therefore it is important to plan everything minutely. If you start calling a real estate agent randomly without planning, then you may end up in a mess at the end. So, let me tell you how you can avoid any hassles and buy the home of your dreams easily and effortlessly.

Step 1: Decide if you are committed to buy a house

Buying a home of your own, especially your first home is considered a huge achievement. Buying your first home or constructing a house on your land is definitely a life milestone, and it’s worth celebrating. However, when you choose to buy a home, you are up for a long-term financial commitment. Buying a house involves a lot of money in terms of down payment, mortgage loan repayment, registration taxes and future expenses like property tax and maintenance expenses.

While it’s great that you have decided to buy a home, you should carefully assess your current and future financial position. Even if you have been saving money to make the initial payment, if you are considering taking a housing loan, then you should have a constant flow of income to repay the home loan.

Here are a few things to consider that can help decide if you are committed to buying a house:

- If you have the cash or liquid assets to pay the down payment

- If you have a secured job or you have a constant monthly income

- Your monthly expenses are quite less than your monthly income

- If you can save a good chunk of money every month to repay the mortgage loan

- If you expect to increase your annual income by expansion or increment at job

If you have the money to pay the down payment, and you can manage to get a housing loan then you are good to go.

Step 2: Figure out a budget for buying a house

Now, that you have decided to buy a house of your own, it’s time to check your affordability. Even though you are planning to avail of a housing loan, you still need to arrange 25-35% of the total property value to make a down payment and manage other expenses associated with buying a house like the property registration fees, stamp duty and other legal and tax expenses.

A detailed financial analysis will help you prepare a budget for buying a house. As you already know, buying a house involves several direct and indirect expenses e.g. actual cost of property, registration and stamp duty, interior design and decoration expenses taxes etc.

If you have a good credit history, you can easily get around 75-80% of the property value as a housing loan. However, your recent monthly income will be considered as well, because the lenders know that you will be able to use only a part of your monthly income to repay the loan.

So take a good look at your income-to-expense ratio and then figure out how much money you can save that can be used to repay the housing loan as monthly EMI. Moreover, you don’t want to get caught up in a situation where paying the EMI becomes an issue. So analyze your income and expenses closely and then decide on a comfortable budget.

Step 3: Arrange money for down payment

You can expect to get nearly 75% to 80% of the property value financed through a housing loan. The exact loan amount may depend on your financial health as well as your credit history. However, if you have a constant source of income, and you have a good credit history, then you can easily get a housing loan from a private or national bank.

However, you still have to manage the down payment which can be around 20-25% of the total property value. On top of that, you need some margin money to take care of other expenses involved in buying a property.

So assess all these expenses and arrange the funds that you would require to pay as a down payment and manage other associated expenses.

Step 4: Find a real estate agent

Although this is not an absolute requirement, having a professional real estate agent can help you in many ways. They can help find multiple properties that may suit your space requirements, lifestyle and budget. They can even help negotiate and bargain for better deals with the sellers or developers.

Here’s how you can do it right

- Meet a real estate agent and check how they can help

- Share your property requirements like the number of bedrooms, bathrooms, overall property size etc

- Discuss key features and amenities you are looking for in your dream home

- Let them know the tentative budget and down payment you can make

- Check if they can help with the housing loan application

You can definitely go out there searching for a house randomly and buy a house without a realtor or a real estate agent. But, a professional real estate agent can add serious value to the home buying process, and they can help find a suitable property that’ll meet your budget, lifestyle and space requirements.

Real estate agents are the experts in this field and therefore if you are buying your first home, you should consider meeting a professional and established real estate agent and seek professional help.

Step 5: Search and select a house

If you have a professional realtor working with you, then they can easily show many properties quickly. However, if you have decided to go solo then make sure to visit as many houses and properties available for sale as you can. There is no harm in viewing multiple properties that meet your requirements. Then, go over each of these properties, evaluate everything, look at the pros and cons and then choose the house of your dreams that meets your budget and lifestyle.

Although different home buyers have different lifestyles and priorities, here are a few things that are common to everyone buying a house. So, here’s a list of things (not in any order) that may be important for you to consider.

- The total price of the property, including parking

- Size of the property i.e. total billable square feet area

- Build area and carpet area of the house

- Number of bedrooms, bathrooms, balconies, terrace etc

- Lifestyle amenities like swimming pool, gym room, games room etc

- Quality of construction and fittings

- Open space and cross-ventilation features

- Location and neighborhood

- Transportation and connectivity in the area

- Water logging issues on rainy days

As I said, there can be different ways to evaluate a property because different people have different requirements and priorities. So, feel free to add what is important for you in your dream home and then order this checklist based on priority for every property you are viewing.

Once you have had enough options, you can simply evaluate and remove properties that do not match your expectations and requirements. Once you are left with just a couple of open properties, you can choose one that suits your requirements and budget.

Step 6: Apply for a housing loan

Now that you have selected the house you want to buy, it’s time to mobilize funds for booking and then further payments to get the property registered. Thankfully you can avail of a housing loan which is offered by both private and public sector banks in India to buy or construct a house. Any individual can apply for a housing loan. However, there are certain documents that have to be submitted along with the loan application form to avail of a home loan.

As there are many banks and lenders that can offer a housing loan to you, it would be wise for you to contact a few of the banks, including the bank where you have your own business or savings account. However, don’t just rely on one bank, because different banks offer different rates of interest, charge different loan processing fees and may offer different features. Hence, it is important to check with multiple banks and learn what are the pros and cons of their housing loans.

When you compare different offers, you will be able to make up your mind and finally choose a bank where you can apply for a home loan.

The home loan application process is not that complicated.

- Visit the bank’s branch

- Collect the loan application form

- Fill in the form and attach self-attested copies of all the documents

- Submit the filled and signed loan application form

Commonly asked documents include KYC (Aadhar, PAN card, Income tax return of last three years, salary slip (for job holders), Company ITR of last 3 years for self-employed, bank passbook/statement of last 6 months, two or three passport size photographs and a cheque for loan processing fee.

Moreover, your loan agent or the relationship manager at the bank can help you through the process of application.

Once you submit the loan application, the bank will review and approve or reject your application. When they approve, they will call you at the branch for document verification and sign the loan agreement. Once the loan agreement is signed, you are through.

Step 7: Inspect the property

The house you are buying will be inspected by the bank. This is just to ensure that the property is in the right shape and that the money you are taking is actually to buy the property. Depending on whether you are buying an under-construction house, a ready-to-move house or a resale property, the property inspector will inspect the property and prepare a report. Since the property is going to be mortgaged, the bank or the lender would like to ensure that the property is worth the price. This inspection will be carried out by the bank, and you may or may not know about the result as this is by the bank and they do this for their records.

However, since this is going to be your home, you should also inspect the property correctly. Look for overall construction quality, any sign of damage, cracks, moisture, leakage etc. Irrespective of whether this is an under-construction house or a ready-to-move house, once the deal is signed and you get possession of the house, all the repair and maintenance has to be carried out by you.

And therefore, it is a must-follow step when you are buying a house. Carefully inspect the property, and take your family and friends along with you, so that you don’t skip on anything essential while inspecting the house to buy. And if you are fully satisfied, then you are ready to get the property registered.

Step 8: Registration and possession

Registration is a one-day affair, and if you are buying an under-construction house, then the seller or the developer will assist you through the process. You have to pay the registration fees, which vary from state to state and even area to area. You have to pay for procuring the stamp papers and other legal fees.

Apart from that, just be double sure to carefully check the registration agreement or sale deed.

- The deed should have the correct information about the property

- Check the house size, parking information etc

- Check and ensure that your name, address etc is correctly spelt

- Check that the total property consideration amount is correct

- Make sure to check that all the payments made are mentioned

Once you are satisfied with everything, you will be good to sign the papers and get the house registered and take possession of the house.

Final conclusion on buying a house

Buying a home, especially the first home can be a lengthy and overwhelming process, especially if you go searching and shopping randomly:

- Without thinking about the kind of property you need

- How much money you can pay as a down payment

- How much of a housing loan you can get

- How do you plan to repay the mortgage loan?

- What size and type of property is best for you

If you have decided to buy a house, you have to plan the budget, choose the right location, find the perfect size home that’ll meet your space requirements and finally you have to secure a housing loan.

As you can see, it involves many steps and each of these steps can be crucial. We have already simplified the entire process of buying a house by dividing it into 8 easy steps. If you just follow these steps and plan every step correctly, then it’ll help you avoid many hassles and issues commonly associated with buying a house.

What else do you think one should do when buying a house in 2021? Share your favourite tips and hacks by commenting below. And if you have any questions about buying a house, feel free to ask below. We’ll be happy to answer your questions and help you through.