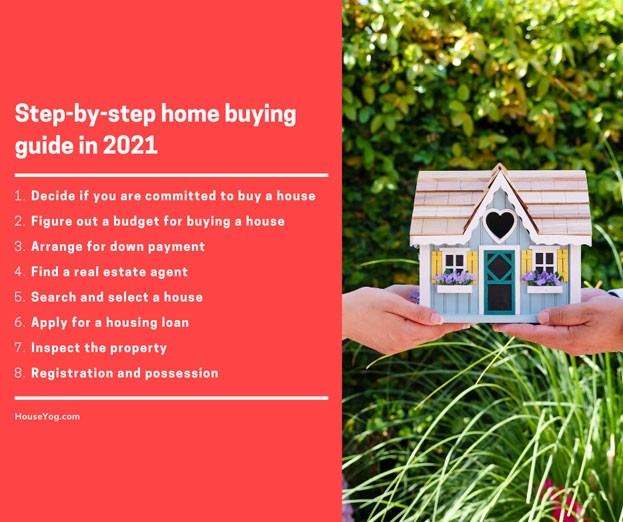

If you want to buy a ready to move flat or an under construction apartment, you can most likely avail a home loan (subject to eligibility and documentation) and get the flat registered in your name. But what if you don’t want to buy a house, rather want to build a home of your dream on a plot of land? Well, you can still apply for a home construction loan.

If you already own a plot of land, and you want to build your house as per your space requirements, then there is a specific type of home construction loan that you can avail. If you are planning to build a house of your own instead of buying a flat, and you are wondering about home construction loans, then I have got you covered.

Today in this post, I am sharing everything worth knowing about home construction loan, including:

- What is a home construction loan?

- Difference between home construction loan and a housing loan?

- What are the common types of home construction loans you can avail?

- What’re the eligibility criteria to get a house building loan?

- What are the documentations required to get a house construction loan?

- What is the interest rate for home construction loans?

- How to get a home construction loan approved easily?

- Process of disbursement of loan amount

- Repayment of loan amount and pre-EMI payment

So are you ready?

Let’s dive in.

What is a home construction loan?

Home construction loan as the name suggests is a kind of loan that you can avail to construct a home of your dream on your owned land according to your preference and space requirements. If you have a freehold plot of land that you might have purchased or inherited or leased for more than 49 years then you can get a home construction loan from leading banking and financial institutions in India.

Difference between home construction loan and a housing loan?

Home construction loans are a little different than the housing loans.

A housing loan is taken when you want to buy a ready to move flat or an under construction house from a developer or a third party in case of re-sale.

However, a home construction loan can be taken to build and construct a house on your own plot of land. You can also avail house construction loan for a leased plot of land, but the lease must be for a longer duration of time like over 50 years.

Moreover, the process of documentation, approval and disbursement of loan amount in case of home construction loan is also a little different than the common housing loan.

Both housing loan and home building loans are offered by different public and private sector banks and financial institutions.

What are the common types of home construction loan?

If you have decided to build a house of your own instead of buying a flat then you have three options to finance your dream home construction projects:

Self-construction loan

You can avail this loan only if you have the free-hold or leasehold plot in your name. So if you have a plot looking for financial help to build a house on your owned or leased land then you can elf-construction loan.

Loan for land and construction

In case you want to build a house, but you don’t own a plot and you want a loan to buy a plot of land and then construct a house, then you can avail this loan option. However, the objective of plot plus construction loan is to help you buy a plot and then build a house on it. So, if you are planning to just buy a plot for now, and then not construct a house on this plot for many years, then you can’t get a loan.

Renovation and extension loan

Renovation and extension loan can be availed when you already own a house, and you want to extend or undertake major renovation work. For instance, if you have a one floor home and you want to build a second floor, or a couple of rooms on the top floor then you can apply and avail loan for such extension.

However, you should also keep in mind that the amount disbursed against the home construction loan cannot be used for any other purpose, other than home construction. You can’t use the amount for interior decorating, furnishing or buying home appliances like fridge and television etc.

What’s the eligibility criteria to get a house building loan?

In order to apply and get a house building loan, you have to provide required documents to prove that you are eligible for such a loan and that you will be able to repay the loan.

Most of the banking and financial institutions that offer home construction loans will have the same or similar eligibility criteria. However, sometimes loan eligibility criteria may differ and therefore it makes sense to compare and check with a few institutions before applying for such loan.

Here are the key eligibility criteria to get a self construction home loan:

- You must be a resident of India

- Your age should not be less than 21 years at the time of application

- You must be either salaried or self employed (business or professional)

- You must own a plot of land (purchased or inherited)

- Competent to sign a contract

What’s the documentation process for a house construction loan?

The first and most important document required to get a home construction loan is to submit documents to prove your ownership for the land where you plan to build a home. It includes all the documents that can prove that you are the legitimate owner of the land.

Some of the most common documents related to the ownership of the land includes, tax receipt of the land, mutation certificate, sale deed/gift deed/lease agreement of the land in your name etc.

However, some financial institutions will also ask for the no-encumbrance certificate for the land where you want to build the proposed house.

Next, you have to submit the house construction plan approved and sanctioned by the local authority/ municipality (in case of municipal area) or from Gram Panchayat (in case of rural area).

Apart from these documents, the financiers will also need the estimated cost of construction (bill of quantity) verified and signed by a qualified and eligible architect or a civil engineer.

And then, you have to provide the common KYC documents (know your customer) like AADHAAR card, Pan Card, Ration card /address proof and income proof documents which is commonly required for any relation with any banking or financing institution in India.

And if in case you are buying a plot, here’s a detailed post that you may like to check on choosing the best plot of land as per vastu guidelines.

What is the interest rate for home construction loans?

There are a number of private and public banks and financial institutions that offer home construction loans at attractive interest rates. However, interest rates for home construction loans may vary from bank to bank and therefore it’s better to check with the banks for the best interest rate before applying.

Here’s the home construction loan interest rate chart for some of the popular banks in India, as on 26/02/2021 for a loan term of 25-30 years.

| Name of the Bank | Rate of interest |

| Axis Bank | 6.75% |

| CitiBank | 6.75% |

| HDFC | 6.80% |

| SBI | 6.80% |

| ICICI Bank | 6.80% |

| Bank of Baroda | 6.85% |

Apart from the interest, some banks may charge for processing and documentation fees and that again vary from bank to bank. Rate of interest and processing charge for home construction loans keep changing periodically and therefore we suggest you check the current rate of interest before applying for a loan.

How to get a home construction loan approved easily?

Developers and builders usually get their projects approved with one or more banking and financial institutions to ensure that their customers can get home loans without much hassles. In fact, the bigger developers in major cities can get all the documentation done for you or connect you to baking people who can help you through the process of application and reimbursement.

But, when it comes to home construction loans, you have to deal with the banks directly and therefore it is important to plan everything correctly and get the documentation right before applying.

Here are a few of the tips that can help you get a home construction loan fast and easily.

Start saving for your part

80 to 85% of the total construction cost can be financed, which means you have to plan for around 20% of the construction cost plus. Moreover, you should also keep some cash for other value added services like making house plans, construction estimates and other documentation purposes. Unless you have saved that much money, there is no point in applying for a home construction loan.

Maintain good credit score

Before approaching a private or public sector bank, you should up your credit score. Credit score is a vital factor that says a lot about your financial discipline and it’s an absolute must for you to maintain a good credit score.

Pay any EMI or credit card bill etc on time to maintain a good credit score. If your credit score is poor at the time of application, then your file may get rejected, so maintain a good credit score.

Get the documentation right

You already know about the documentation, so get the documentation right. Get the mutation done, clear all taxes, make a house plan by an expert architect, get a detailed construction estimate prepared and signed by an architect etc.

Apart from that, you also need to get other financial and KYC documents prepared, so collect all your salary slip (income proof), IT filings for the last three years etc.

Get the house plan and construction estimates done

This could be a time taking project, but it’s vital for getting a home construction loan approved. So, hire an architect or an architectural firm to get your house plan designed. Once the house plan and elevation is ready, get them to prepare a detailed construction estimate.

Work with reliable builders and contractors

Disbursement of home construction loan amount is linked with the progress of construction. So, it is important for you to work with the most reliable and trustworthy builder who can work fast. If the construction is delayed for any reason, then you will be at loss because you will be paying interest on the amount that’s already disbursed by the bank.

Keep room for increase in prices

While preparing home construction estimates, always keep room for additional expenses, because the cost of construction materials like steel, cements, bricks etc keeps on fluctuating, so the cost may go up anytime. But that should not pause or stop the construction work.

Process of disbursement of loan amount

Disbursement of home construction loan is linked with the stages and progress of actual construction of the house.

They’ll release the amount in 4 or 5 parts after reviewing the progress of the home construction work on your plot.

You should not expect to get the total approved and sanctioned loan amount credited to your bank account in lump sum.

For instance, if you have applied for a loan of 20 lacs, which is around 80% of the total construction cost, then the first payment will be released only after the plinth level work is over. A bank representative will review the progress before disbursing the amount.

So in a way, when you have already invested your part of money, the bank will disburse a part of the sanctioned loan amount.

Repayment of loan amount and pre-EMI payment

Some banks start charging pre EMI (Equated Monthly Installment) payment, which means that after the first installment of disbursement, they will start charging the interest amount on the amount they have already paid. Actual EMI will only start after the full payment and when the hoe construction work is over.

Conclusion

Building a home of your own, on a plot of land can be phenomenal. When you build a house of your own, not only do you get the liberty to design and build it the way you want, you also get to expand and add extensions as needed.

If you already have a plot of land, then building a house becomes much easier with a home construction loan. The rate of interest on a home construction loan is much cheaper than other personal loans. Moreover, you also get longer tenure to repay the loan amount, and you get some tax benefits under different sections of Indian tax laws.

If you prefer to live in an independent house than living in a flat, then building a house of your own with a home construction loan can be a good option to consider.

I have already shared everything you should know about a home construction loan, the eligibility, documentation process, how to apply and get a loan approved and about the disbursement and repayment of loan amount.

Hope it’ll help you get a home construction loan fast and effortlessly.

What else do you think one should know about home building loans?

Share your tips and experiences by commenting below!

Happy home building!