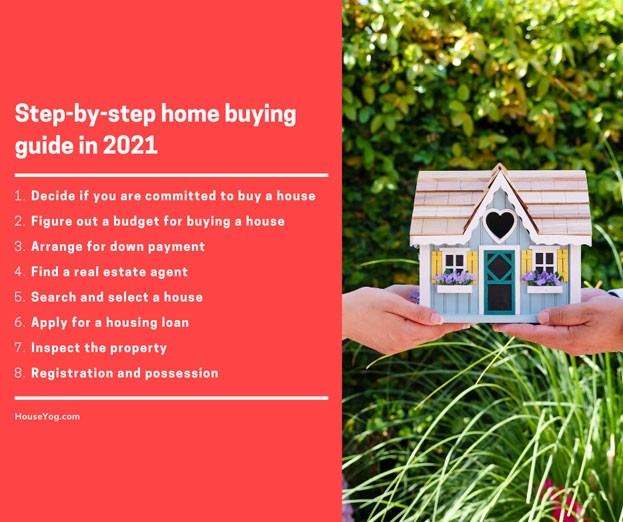

Buying a house is a significant personal achievement for anyone. However, it requires a substantial amount of money to purchase a house or flat in India. Even with various home loan options available, buying a house demands substantial initial investments. It is crucial to accumulate sufficient savings, especially for the initial down payment to make your dream home a reality.

Furthermore, addressing additional expenses such as property tax, stamp duty, and property registration costs is crucial. Starting the savings journey early, ideally in your mid-20s, can help you amass the necessary funds within a span of 8-10 years.

If you are planning to purchase your dream house and are wondering how to save money and accumulate a sizable fund to cover the down payment and other initial expenses, then we have got you covered.

Today in this post, I am sharing a few of the best and most valuable tips and strategies that will help you save money effectively for the purchase of your dream home in India or anywhere in the world.

Tips and Tricks That Help Save Money to Buy a House

Saving money to buy a house is a crucial financial decision that demands careful financial planning, discipline, and time.

Here are some tailored tips that will easily help you save money for purchasing a home in India:

Set Clear Financial Goals

As you already know, real estate prices are increasing every year. It becomes seriously important to set a financial goal and figure out the amount of money you need. Clearly outline the amount you may need to cover the down payment, along with additional costs like stamp duty charges, registration fees, and other related expenses like interior decoration, etc. Defining specific financial goals will help you plan your savings effectively.

Create a Monthly Budget

Now that you know the amount of money you have to accumulate to buy a house of your dreams, the next step is to start saving and investing the money. Creating a monthly budget helps get the complete picture of your income and expenses. To begin with, start monitoring your monthly income and expenses. Identify areas where costs can be trimmed. It is important to exercise caution with unnecessary expenditures and allocate more funds towards your savings goal.

Open a Dedicated Savings Account

Having a dedicated savings account can be an aggregate strategy. By opening a separate savings account, you cultivate a disciplined approach to your savings and investing. This segregation acts as a protective measure, shielding your home fund from inadvertent utilization for non-essential expenses. Consider opening a separate savings account specifically for your house down payment. This will help you keep track of your investment progress and prevent you from dipping into the funds for other household purposes.

Automate Savings

Saving and investing are all about timely and disciplined investment. Automating your savings every month helps ensure a fixed amount gets invested towards your home fund without any intervention from your side. This way, you will never miss an investment and therefore you can benefit from long-term compounding. Consider automating the transfer from your salary account to your savings account towards the home fund. This ensures a regular portion of your income is directly allocated to savings, eliminating the need for manual intervention.

Cut Unnecessary Expenses

It is not easy to get rid of the temptation to buy things and spend money on your today’s needs. But, if you want to save money to purchase a house or a flat, you have to think long-term. Assess your spending habits and identify areas for reduction of costs. This may involve cutting back on dining out, curbing impulse purchases, or finding more cost-effective alternatives for regular expenses.

Increase Your Income

While cutting unnecessary expenses, saving, and investing regularly will help you accumulate funds to cover the down payment and other expenses, if you can improve your income, you will be able to save more and reach your financial goal faster. Explore different options that can help you increase your earnings and income, such as taking on part-time employment, freelancing, or starting a side business. Even a bit of additional earnings can significantly accelerate your savings for buying a home of your own.

Invest Wisely

While saving money is crucial, investing your money wisely is even more important. If your investment is not beating the rate of inflation, then your money is not growing. Therefore, consider investing your money in instruments offering higher returns than a regular savings account. Options like mutual funds investment are proven to offer a better return on investment in the long run. Seek advice from a financial advisor and be aware of associated risks.

Take Advantage of Government Schemes

While you are saving and accumulating funds to take care of down payments and other expenses when buying a house, don’t forget to take advantage of various government schemes. Check out the government-backed housing schemes and incentives that you may be eligible for. Some of the government schemes provide subsidies and tax benefits, especially for first-time homebuyers that you can benefit from when buying a house.

Stay Disciplined

Cultivate discipline and patience in your savings approach. Remain dedicated to your financial goals, steering clear of unnecessary debt that may impede your ability to save. Remember, staying informed about market trends and economic conditions is crucial due to their influence on property prices. Additionally, seek guidance from a financial advisor to tailor a savings plan that can help you accumulate a good sum of money to buy a house in India.

Conclusion: Your Path to Homeownership Begins Here

Embarking on the journey to homeownership is a significant endeavour, one that demands careful planning, financial discipline, and a commitment to your goals. As you aspire to buy your dream house or flat in India, the road may seem challenging, but with the right strategies, you can pave your way to success.

From setting clear financial goals to creating a monthly budget, opening a dedicated savings account, and automating your savings, each step is a crucial building block in your quest for a home. Cutting unnecessary expenses, exploring avenues to improve your income, and investing wisely are key components that accelerate the realization of your homeownership dream.

Remember, patience and discipline are your allies in this financial journey. Start early, stay informed about market trends, and take advantage of government schemes designed to support your endeavour. Seek guidance from a financial advisor, customize your savings plan to fit your unique circumstances, and watch your dream of owning a home in India materialize.

With these tips and strategies in hand, you’re not just saving money; you’re creating a foundation for a future filled with the pride and joy of calling your own space ‘home.’ Your dream home awaits – stay focused, stay disciplined, and let your journey to homeownership unfold with purpose.

Happy saving and here’s to the key that unlocks the door to your dream home!